Covariance is a measure of the joint variability between two random variables. It essentially measures how similarly these variables move together over time, or how much one variable changes as the other does.

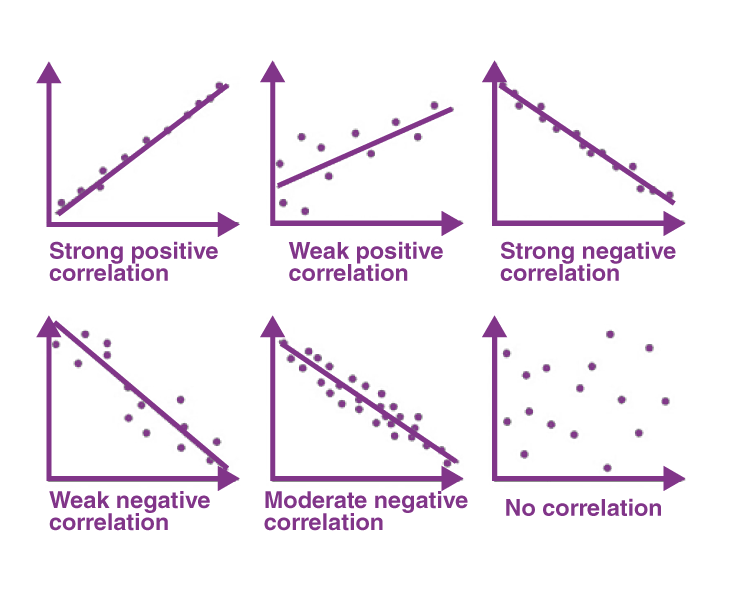

Covariance is a measure of the joint variability of two random variables. If the greater values of one variable mainly correspond with the greater values of the other variable, and the same holds for the lesser values, that is, the variables tend to show similar behavior, the covariance is positive.

A positive covariance means that the variables change in similar directions, while a negative covariance suggests they move in opposite directions. In its most basic form, it is calculated by taking the average of products of deviations from their respective means.

Uses of Covariance

Covariance can also be used to measure relationships between more than two variables; for example, it can capture how well an entire portfolio of investments moves when compared to a benchmark index.

It can also be used to measure how well different stocks move against each other – if they tend to rise and fall together, then they have a high covariance; whereas if one rises while the other falls (or vice versa), then they have a low covariance.

In addition to being useful for measuring the correlation between two or more variables, covariance can also be used to estimate the variance of a variable given its relationship with another variable.

This allows us to make predictions about future values of either variable based on past observations. For example, using covariances between stock prices and company earnings we can predict future earnings based on current prices and vice-versa.

Advantages and Disadvantages

Like any other statistical concept, covariance has its advantages and disadvantages. One of the advantages of covariance is that it can be used to identify relationships between variables. When the covariance is positive, it indicates that the two variables move in the same direction.

Therefore, if one variable is known, the covariance can be used to predict the behavior of the other variable. This makes covariance a valuable tool in predictive modeling for businesses, economics, and finance.

However, one of the disadvantages of covariance is that it does not consider the magnitude of the variables. This means that two variables with very different magnitudes can have a high covariance, which can be misleading. For example, the covariance between a person’s height and weight would be much larger than the covariance between a person’s salary and their age, even though both relationships could be considered positive.

Another disadvantage of covariance is that it only measures linear relationships between variables. This means that if the relationship between two variables is not linear, then the covariance would not be an accurate measure of the relationship.

In such cases, other statistical concepts such as correlation or regression could be used instead. In conclusion, covariance is a statistical concept that has both advantages and disadvantages. It is useful in identifying relationships between variables, but its limitations must be considered before using it. Therefore, it is necessary to have a sound understanding of covariance and its applications before applying it in decision-making processes.

Summary

In summary, covariance provides an invaluable tool for investors and businesses seeking to understand relationships between complex data sets and make informed decisions about their investments or operations. By measuring the joint variability among different variables and estimating future values based on their relationships with each other, we are better able to identify trends and create profitable strategies for our investments and operations. On the other hand, when covariance is negative, it implies that the two variables have an opposite behavior.